Count Your CHIPS: A Primer on the Accounting and Financial Reporting Implications of the CHIPS Act for Advanced Manufacturing Companies

By Matt McCormack, Manager, Client Accounting & Advisory Services

The Creating Helpful Incentives to Produce Semiconductors and Science Act (the “CHIPS Act” or the “Act”) of 2022 aims to bolster US semiconductor manufacturing, research, and development to enhance national security and technological leadership. The Act provides significant funding and incentives for domestic chip production to reduce reliance on foreign supply chains and foster US competitiveness in the global economy. Additionally, it promotes public-private partnerships and workforce development initiatives to support the semiconductor industry. Some of the major provisions of the CHIPS Act include the following:

- Approx. $53 billion in manufacturing subsidies, grants, and loans for the US semiconductor industry

- An “advanced manufacturing tax credit” for certain investments in semiconductor manufacturing

- Approx. $200 billion in funding for R&D programs and workforce development, to be determined by Congress in future appropriations bills over the next ten years

Now two years on from the CHIPS Act being signed into law, the US Department of Commerce has so far announced over $30 billion in proposed CHIPS private sector investments, with representative projects in 15 different states.1 Earlier in August 2024, the Korean semiconductor giant SK Hynix announced it entered into a preliminary agreement to receive up to $450 million in CHIPS funding. The company sought these funds as part of their larger plan to invest almost $3.9 billion in new manufacturing facilities in Indiana, a move that would create approximately 1,000 new jobs.2 With all of this funding flying around, recipients must understand the terms of their specific arrangement and ensure proper financial accounting and reporting. In this article, we will explore the accounting implications of the CHIPS Act’s semiconductor provisions.

Accounting for government assistance

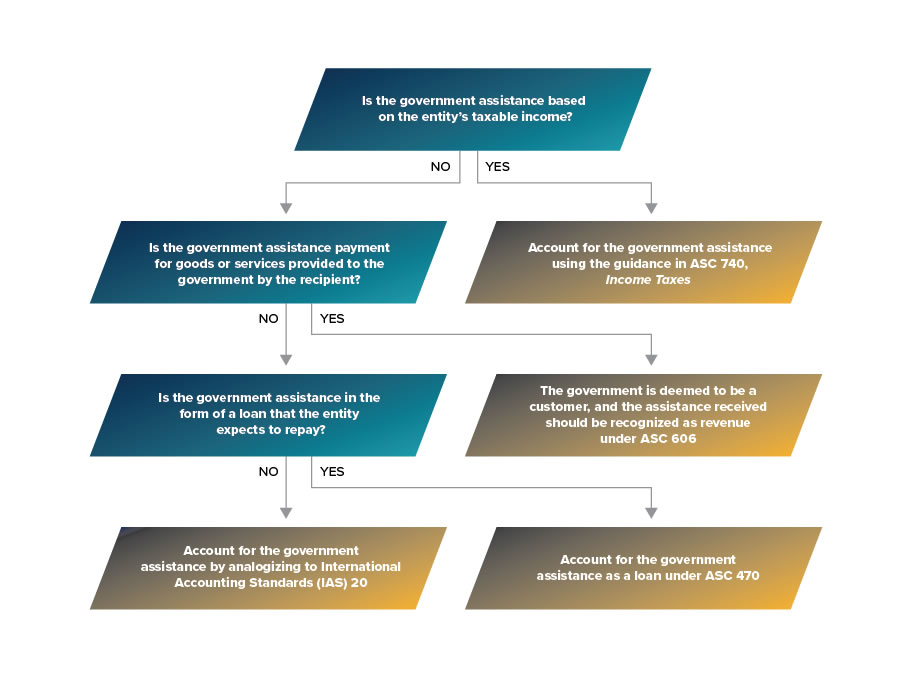

Each program established under the CHIPS Act has specific requirements that an entity must thoroughly evaluate to determine eligibility and the correct accounting treatment for any assistance received. Specifically, for-profit business entities should assess whether the assistance falls within the scope of existing authoritative guidance from the Financial Accounting Standards Board (the “FASB”), such as an income tax credit under Accounting Standards Codification (ASC) 740, a payment for goods or services under ASC 606, or a loan under ASC 470, based on the program’s terms and conditions. The accounting and disclosure implications, including the timing of recognition and financial statement presentation, may differ significantly based on this assessment. For this reason, a thorough analysis must be performed, as the terms used within the agreement (such as “grant” or “credit”) may not reflect the accounting implications.

The following is an illustration of the analysis a for-profit business entity must perform to appropriately account for government assistance received as part of the CHIPS Act:

Government assistance within the scope of ASC 740

The advanced manufacturing tax credit (the “AMIC”) covers the actual manufacturing of semiconductors and the specialized tools needed in the manufacturing process. It is generally equal to 25% of the initial qualified investment in such assets. The AMIC is available for qualifying property placed in service after December 31, 2022, and applies to assets for which construction begins before January 1, 2027.

The AMIC permits an entity to either 1) use the credit as payment or 2) receive a refund for the credit if there is no taxable income and a tax liability to offset. Therefore, the AMIC is not considered to fall within the scope of ASC 740, as the benefit of the credit is not dependent on the presence of taxable income or taxes payable.

Agreements where the government is a customer

In certain situations, government assistance may constitute payment for goods or services the recipient provides. If the goods or services are an output of the entity’s ordinary activities, the government should be considered a customer. An entity should then apply the five-step model under ASC 606 and recognize the government assistance as revenue.

Loan which the recipient expects to repay

Certain CHIPS Act grants that have been announced thus far, including the SK Hynix deal, refer to specific amounts of the total funding package provided in the form of loans from the government. For government assistance received in the form of a loan, the general expectation is to account for the amounts in accordance with ASC 470 (that is, in a manner consistent with other forms of debt). The answer becomes muddled if the loan contains terms or provisions that make the borrowings forgivable and the borrower expects to satisfy any criteria for forgiveness. Refer to the discussion below for such situations.

The “other” bucket – analogize to IAS 20

While the FASB has recently published new guidance on the disclosure of government assistance (ASC 832), there remains limited guidance within US GAAP on the actual accounting for such amounts, resulting in diversity in practice. For government assistance received as a grant not filtered out by one of the above screens, the general expectation is that a for-profit business entity would account for the grant in a manner similar to International Accounting Standards (IAS) 20.

IAS 20 outlines two distinct categories of government grants – grants related to assets and income. For grants related to assets (the AMIC, generally, is considered to be such a grant, the recipient should present the amount on its balance sheet as either a reduction of the carrying amount of the related asset or as a deferred income. For grants related to income, amounts should be classified in the income statement as either an “other income” item (or, if significant enough, as a separate financial statement line item) or a direct reduction of the related expense. IAS 20.12 states that a grant should be recognized as income on a systematic or rational basis over the period that matches the associated expenses.3

The guidance in IAS 20 notes that government grants are recognized when there is “reasonable assurance” that the recipient will be able to satisfy the terms of the grant and will receive the amount. In practice, the “reasonable assurance” threshold is comparable to the “probable” standard in US GAAP. Funding under the CHIPS Act and other forms of government assistance may contain conditions by which all or a portion of the funding can be clawed back. For this reason, an entity should not recognize the amount of government assistance simply because the funds are received.

Accounting for the CHIPS Act funding and other forms of government assistance can be a nuanced endeavor. Our team of experienced professionals can provide guidance and support in navigating these accounting considerations, ensuring compliance with applicable accounting standards and accurate financial reporting.

Sources

- https://www.commerce.gov/news/blog/2024/08/two-years-later-funding-chips-and-science-act-creating-quality-jobs-growing-local

- https://news.skhynix.com/preliminary-mou-terms-signed-with-us-doc-for-advanced-packaging-facility-in-indiana/

- https://www.iasplus.com/en/standards/ias/ias20