International Tax Reclamation: Debunking Misconceptions and Uncovering Opportunities

By Len A. Lipton, GlobeTax

Does your fund invest in international securities? If so, there’s a good chance you’re overpaying your taxes.

When foreign securities – either ordinary shares or depositary receipts – pay dividends, that income is often subject to foreign withholding taxes in addition to taxes in the domestic jurisdiction. To mitigate this double taxation, pairs of countries enter into bilateral treaties that allow investors to reclaim all or part of the withholding tax on foreign dividends.

Unfortunately, the recovery process is less-than-straightforward. It entails compliance with vastly different requirements and procedures for each jurisdiction around the world. In each market, investors must complete the requisite country-specific documents – often in the local language – and provide evidence of residency and security ownership on the dividend record date. Signatures from account holders and fund investors must be secured and forms filed into the proper jurisdiction. All of this involves liaising with one or more counter-parties in the global custody chain, whether the global custodian, withholding agent, broker, depositary, or in country agent bank. Compounding matters, these processes must be completed without error and within the statute of limitations—or the investor forever loses their rightful entitlement.

The majority of funds lack the internal infrastructure necessary to navigate the treaty landscape to identify and recover all available entitlements. Externally, support from prime brokers is inconsistent. Funds are often reluctant to share the beneficial owner data needed for claims, and prime brokers typically lack the capacity to perform the highly manual reclaim process.

Absent reliable sources of information about the complex and fast-evolving withholding tax arena, misconceptions are widespread. Fortunately for fund managers, such complexity also breeds opportunity. New laws, practices, frameworks, and investment vehicles regularly emerge, yielding new ways for opportunistic portfolio managers to maximize their entitlements. Below, we discuss two common misconceptions and three opportunities that funds can leverage to improve portfolio performance and increase AUM.

Misconception 1

“But I don’t own any foreign securities…”

U.S. investors can access foreign securities through two main channels: purchasing a share in its home market (e.g. buying Sony on the Tokyo Stock Exchange) or by acquiring the American Depositary Receipt (ADR) in the U.S. market (e.g. buying the Sony ADR on the NYSE).

Investors holding ADRs often do not realize that they own foreign securities, considering that they bought the instruments on a U.S. exchange. In fact, companies that seem quite commonplace in everyday American life—Anheuser-Busch, Accenture, Unilever, Nestle—are all subject to foreign withholding taxes. Fortunately, as with the purchase of shares on foreign markets, investors can use double taxation treaties to recover over-withheld taxes. The key difference is that ADR reclamation procedures must be initiated through the depositary institution that issued the instrument (BNY Mellon, Citibank, Deutsche Bank, or JP Morgan) rather than through the foreign tax authority.

Misconception 2

“I can just take a foreign tax credit…”

Many investors assume they can side-step the reclaim process by simply taking a foreign tax credit. On the contrary, IRS statutes prohibit such behavior in many instances. This is made clear in the instructions for IRS Form 1116:

You can’t take a credit for the following foreign taxes:

- Taxes paid to a foreign country that you do not legally owe, including amounts eligible for refund by the foreign country. If you do not exercise your available remedies to reduce the amount of foreign tax to what you legally owe, a credit for the excess amount is not allowed.

In other words, the IRS only allows investors to claim foreign tax credits on withholdings that are not eligible for recovery. Thus, unless funds engage in a recovery process, their performance will suffer: they will receive 10-35% less of their dividend entitlement. Fortunately, there are methods for obtaining relief.

Opportunity 1

Treaty-Based Withholding Tax Recovery

Treaty-based withholding tax recovery undoubtedly yields benefits, but is often an arduous process, as hedge funds are typically structured as partnerships. Unwilling or unable to share investor information, hedge funds (and their trust, partnership, and omnibus brethren) have suffered disproportionately under tax authority rules that mandate identifying beneficial owners to obtain treaty relief.

To secure relief, onshore (transparent) funds must manage disclosure requirements from the fund (and fund of fund investors) to the ultimate beneficial owner. Offshore funds structured as master feeders may also have an opportunity to claim double taxation treaty benefits. Many tax authorities look favorably upon vehicles where the onshore taxable feeder is a limited partnership (LP) or limited liability company (LLC) and the master fund is a partnership or has ‘elected’ to be treated as one for U.S. tax purposes. Tax authorities often interpret this structure as “transparent,” qualifying at least some of the beneficial owners to recover over-withheld dividend income.

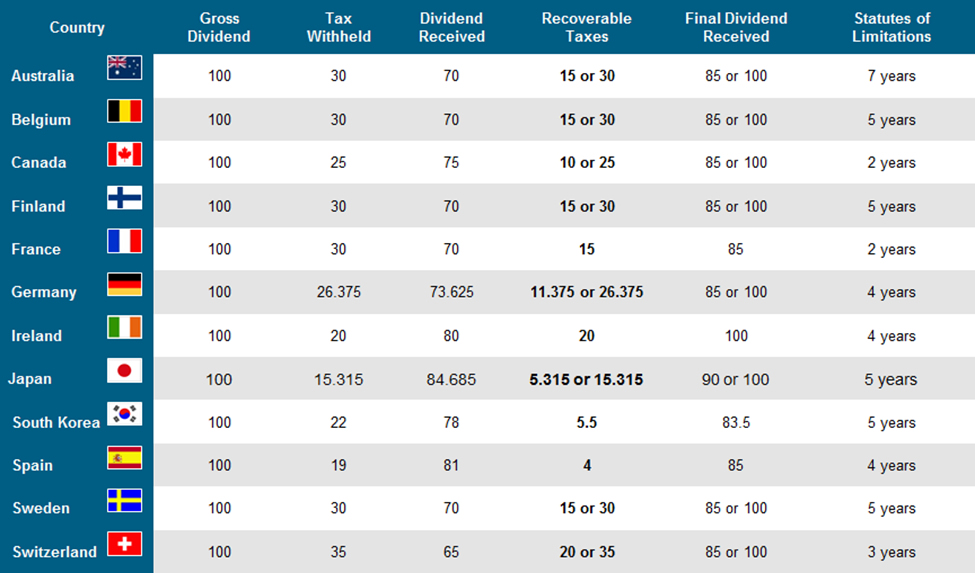

These recoveries can be a boon to portfolio performance. For U.S. based investors, the amount reclaimable ranges from 4% of the total dividend in Spain to 20% in Ireland and Switzerland. Thanks to statutes of limitations – which range from 2 to 7 years – funds can “look back” to reclaim historic entitlements, representing a potential windfall for a first-time claimant.

Opportunity 2

New Cayman Limited Liability Company Structure

Taxable entities are not alone in reaping the benefits of double taxation treaties. U.S. tax exempt entities like pensions and foundations can qualify as well thanks to a new Cayman Islands fund structure.

Traditionally, U.S. tax exempt entities investing through a master feeder structure invest through an offshore feeder – most commonly a Cayman limited company (Ltd.) – which serves as a corporate ‘blocker.’ While providing protection from UBIT, these vehicles subject investors to 30% back-up withholding on all US-sourced income, as well as full withholding rates on dividend payments from other markets. Compounding matters, the opaque nature of the Ltd. structure prevents investors from accessing cross-border treaty entitlements. Although steep, this is the price that U.S. tax-exempt entities pay to avoid UBIT.

At the end of 2015, the Cayman Islands introduced a new vehicle: the Cayman limited liability company (LLC). Based loosely on the Delaware LLC, the structure boasts limited liability, flexible governance, and separate legal personality. Given that many governments treat LLCs as “pass-through” entities, funds using this structure may eliminate the sting of foreign dividend withholdings. Although U.S. tax exempt investors remain subject to 30% backup withholding on all U.S.-sourced income, the new vehicle shields from UBIT and enables reclaim filings through tax treaties: the best of both worlds.

To be clear, because Cayman is not party to bilateral treaties, treaty-based claims cannot be lodged at the fund level. Most markets, however, permit a “look-through” that allows funds managers to file individual claims based on the residency and entity type of eligible beneficial owners. Despite the added work in lodging individual claims, both investors and fund managers would benefit from the improved returns. With over $1 trillion in hedge fund assets domiciled in the Cayman Islands, the ability to access treaty benefits—particularly for U.S. tax exempt entities—would significantly impact fund performance.

Opportunity 3

EU Discrimination Claims

Eligible fund structures can also explore new opportunities in Europe thanks to decisions by the European Court of Justice (ECJ). Cases like FIM Santander and DFA Emerging Markets, among others, have paved the way for non-EU funds to qualify for more favorable tax rates in European Union member countries. In these rulings, the court has found that the ‘free-movement of capital’ provisions in the Treaty on the Functioning of the European Union entitles foreign funds to the same treatment as similarly-structured resident taxpayers; to suffer worse outcomes would constitute discrimination.

U.S. RICs and Cayman-domiciled vehicles can take advantage of the new legal landscape by filing discrimination-based claims with foreign tax authorities. Admittedly, a bit of groundwork is necessary. Fund structures must be compared, evidence gathered, and legal briefs presented to local authorities. Upon receiving the evidence, either the courts or the tax authority will determine whether the fund in question is similarly situated to those granted refunds in prior ECJ rulings, potentially opening the door to a new source of entitlements.

How to Move Forward?

Because tax relief is complicated, the landscape is riddled with missed opportunities. By resolving misconceptions about topics like depositary receipts and tax credits, and investigating opportunities surrounding fund structures and ECJ discrimination lawsuits, funds can boost performance and increase AUM.

It bears mentioning that although these avenues are available, they are not clear-cut. Most funds simply lack the infrastructure to pursue tax reclamation on their own. As a result, unless a hedge fund employs an outside service provider, they will likely suffer statutory withholding rates and deliver sub-optimal performance. In competitive and uncertain times like these, no one can afford to leave money on the table.

Potential Recoveries

About the Author

Len A. Lipton joined GlobeTax in 2004. Mr. Lipton manages the firm’s sales and marketing activities for the Americas. His responsibilities encompass promotion of the company’s services to custodians and asset managers, including spearheading the firm’s business development activities to the hedge fund community.

About GlobeTax

GlobeTax is the world’s leading provider of withholding tax, relief, recovery, and information reporting services for financial institutions and their cross-border investor clients. GlobeTax’s research team monitors tax treaties in over 245 jurisdictions in order to provide withholding tax relief / recovery for clients in over forty countries. Founded in 1992, the firm is based in New York and maintains offices in London, Hong Kong, Madrid, and Sydney.