Carried Interest: What it Represents and How to Value It and Why

By Vladimir V. Korobov, Partner, Valuation and Litigation Support

What is Carried Interest?

As a type of incentive compensation, carried interest and similar profit-sharing arrangements1 have been around for a long time. The notion of carried interest dates back to medieval times and relates to the share of profits that ship captains received on the cargo they carried. The American Investment Council notes that carried interests are found throughout industries and market segments, where one party invests capital and another invests expertise or “sweat equity.”2

Carried interest has been a staple of the private equity and venture capital industries in the United States for many years. In a typical private equity or venture capital fund, outside investors, i.e., limited partners, contribute most of the fund’s capital. The sponsor of the fund, or general partner, contributes only a small fraction of the fund’s capital and receives an equity interest in the fund’s future profits.3

How It Works

Carried interest typically represents a share of proceeds from a sale of a portfolio investment, which is determined using the proceeds allocation formula (often referred to as a “waterfall”) specified in an investment fund’s formational document, such as a partnership agreement. Following is an example of a typical formula for an allocation of proceeds from the sale of a portfolio investment in private equity and venture capital funds:

Initial Allocation: Proceeds from the sale of a portfolio investment are initially allocated pro rata between a general partner and the limited partners based on the partners’ respective capital contribution percentages.

Second Allocation: Proceeds initially allocated to the limited partners are then reallocated between the limited partners and a general partner as follows:

- Step 1, Return of Capital – First, 100% to limited partners until limited partners have recouped their capital contributions used to fund portfolio investments and expenses (including management and other fees);

- Step 2, Preferred Return – Then, 100% to limited partners until limited partners have earned an 8% return (compounded annually) on their capital contributions;

- Step 3, GP4 Catch Up – Then, 100% to a general partner until the general partner has received 20% of the amount distributed to the limited partners in Step 2; and

- Step 4, Residual Split – Thereafter, 80% to the limited partners and 20% to the general partner.

The general partner’s right to receive distributions under Steps 3 and 4 above represents the general partner’s carried interest in the investment fund.5

Why Value Carried Interest?

If an investment fund is successful, carried interest can generate significant distributions to a holder over the fund’s life. It is not a surprise then that this asset has been a popular choice in gift and estate planning for private equity and venture capital professionals in the United States. Generally, a transfer of carried interest as part of gift and estate planning requires a determination of the interest’s fair market value under the U.S. Internal Revenue Code; however, income tax considerations are not the only purpose for valuing carried interests. Questions concerning the value of carried interests frequently arise in litigation (for example, in matrimonial matters and employment disputes), transactions, and financial reporting.

When “Value” May Not Be Value

You may ask:

“If a general partner of the fund determines the values of the fund’s investments as of a given date and calculates the amount of a carried interest distribution, if any, that the general partner would receive upon a hypothetical liquidation of the fund’s investments at those values, wouldn’t the amount of the distribution represent the value of the general partners’ carried interest on that date?”

We often get this same question from our private equity and venture capital clients. And the answer, in most cases, is generally no6 for at least three reasons.

First, a hypothetical liquidation scenario does not capture any potential value of a fund’s “dry powder.”7 This potential value is highest at the earlier stages of a fund’s life. Second, unless there is a reasonable expectation that the investments could be sold off at the values set by the general partner over a short period of time, the hypothetical liquidation scenario does not reflect the time value of money.8 Third, carried interest effectively represents a call option on a share of the fund’s profits over a predetermined threshold; for example, in a typical waterfall allocation, the threshold would be the investors’ capital contributions, plus a preferred return of 8% per annum. Thus, the hypothetical liquidation scenario does not consider a potential for future appreciation of the value of the investments, i.e., the time value of the call option, which can be significant, especially in the early stages of the fund’s term.

So, if the hypothetical liquidation scenario is not the right answer to the question of value of a carried interest in most cases, then what is?

Carried Interest Valuation

The right answer to the above question is the present value of the expected cash flow, or the carried interest distributions expected to be received over the life of the fund. The present value can be determined utilizing either an option-pricing framework, or a discounted cash flow methodology. In this article, we will illustrate a valuation analysis using the discounted cash flow methodology.

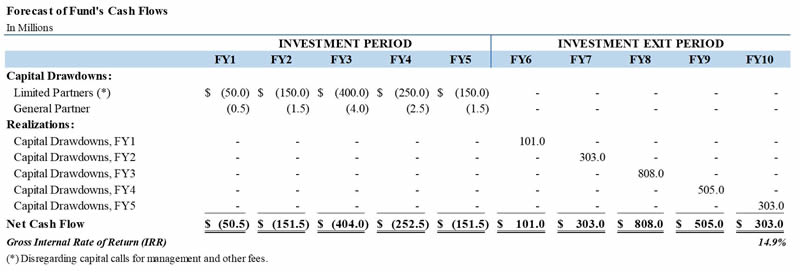

Let us consider the following scenario. A private equity firm has just raised a new fund with $1 billion of investor commitments. The general partner of the fund has made a capital commitment of 1.0% of the investor commitments, or $10.0 million. The fund has a term of 10 years9, which is divided into the investment period (the first five years) and the investment exit period (the last five years). Based on experience with earlier funds and consideration of the expected industry trends and investment opportunities that these trends could present over the next 5 to 10 years, the general partner expects an average holding period for investments to be 5 years, and believes that the fund could realize value of 2 times invested capital. The general partner estimates the following capital drawdown schedule during the investment period:10

Based on the estimated capital drawdown schedule, the expected holding period, and the targeted performance of 2 times invested capital, we can develop a forecast of cash flow over the fund’s term:

We can then allocate the projected proceeds between the general partner and limited partners using the typical waterfall presented earlier:

Now that we have identified the future carried interest distributions – specifically, the distributions to the general partner in Steps 3 and 4 — we can determine the value of the carried interest as the present value of the projected carried interest distributions. Assuming an income tax rate of 23.8%11 and a discount rate of 20%, the value of the carried interest would be $28.0 million, as calculated in the following table:

In Summary

As a type of profit-sharing arrangement, carried interest has been a staple of the private equity and venture capital industries for many years. In these industries, carried interest represents a share of the proceeds from the sale of a portfolio investment that is determined using the allocation waterfall specified in an investment fund’s formational document. Depending on the investment fund’s lifecycle, carried interest has a potential to generate significant cash distributions to its holder; therefore, the issue of a carried interest’s value frequently arises in tax, litigation, and other contexts. In most cases, however, the amount of proceeds that a holder of the carried interest would receive in a hypothetical liquidation of the investment fund at the values of the investments set by a general partner would not represent the carried interest’s value. The value should represent the present value of the expected cash flows, or, in other words, the future carried interest distributions, which can generally be determined using option pricing and/or discounted cash flow methodologies.

SOURCES

1. An example of a profit sharing arrangement similar to a carried interest is a developer’s promote in a real estate development project.

2. American Investment Council.

3. The purpose of the carried interest is to provide an incentive to the general partner and to align the general partner’s interests with those of the fund’s limited partners.

4. Here, “GP” is an acronym for general partner.

5. In “American style” funds, the general partner is allowed to receive carried interest distributions during the fund’s term as portfolio investments are sold. The final accounting of distributions and their allocation between the general partner and limited partners is performed upon the fund’s liquidation. If, during the fund’s term, the general partner has received distributions in excess of what it was entitled to, the limited partners have the right to claw back the excess amount. In “European style” funds, the general partner is allowed to receive a carried interest distribution only at the end of the fund’s term; therefore, a clawback is usually not an issue in these funds.

6. In certain limited situations, the amount of the carried interest distribution in the assumed liquidation of the fund’s investments at the values determined by a general partner may be indicative of the value of the carried interest. An example of such a limited situation would be a European-style fund that is at the end of its term and that is actively disposing of any remaining investments, so that the values of the investments set by the general partner reflect the amounts of actual proceeds expected to be realized in the near future.

7. “Dry powder” generally refers to the investor’s remaining capital commitments to the fund. As an example, a fund with $500 million of capital commitments that has called $100 million of capital would have $400 million of “dry powder,” or capital commitments, remaining.

8. To best explain the meaning of “time value of money”, let us assume that the fund’s investments will be sold at the values determined by the general partner as of a given date, but the actual dispositions are expected to take place over three years. In this – more realistic – scenario, the value of the carried interest will equal the present value of the carried interest distributions calculated using a risk-adjusted rate of return.

9. In practice, a fund’s term can usually be extended to allow for an orderly liquidation of any remaining investments, but, for the sake of simplicity, we will ignore this nuance.

10. For purposes of this illustration, we will disregard management and other fees that limited partners may be subject to.

11. The income tax rate consists of the federal long-term capital gain tax rate of 20% and the net investment income tax of 3.8%. For illustration purposes, we assumed that the carried interest distributions would not be subject to the state income taxes.