Mortgage Backed Securities 2.0 – The Second Coming

By Josh Weiss, CPA, Manager

Many people say that owning a home is part of the American Dream. This was most prevalent in the late 1990’s and 2000’s. However, ever since the 2008 real estate crash, market trends have shifted significantly. As of the second quarter of 2011 the percentage of people who owned a home had dropped to 65.9%, its lowest level since the first quarter of 1998 and a more than 3% decrease from the peak of 69.2% that was reached in the fourth quarter of 2004 (U.S. Census Bureau).

The 2008 real estate crash was a perfect storm waiting to happen. There was a plethora of factors that all came together simultaneously. This article will focus on the major factors that relate to the mortgage backed security and discuss if the new laws and regulations that have been implemented will prevent a future storm.

In order to fully understand the real estate crash, one needs to examine the foundation cracks of the mortgage industry that existed pre 2008 including: 1) lax borrowing standards, including underwriting failures and minimal down payment requirements; 2) variable interest rates, non-recourse clauses and foreclosures 3) misclassification of risk and ratings by the credit rating agencies.

Lax borrowing standards

In 2006 my wife and I applied for a mortgage to purchase our first home. We met with the mortgage broker, went through some paperwork and had a loan commitment to present to the seller less than 24 hours later. We were even offered some “unconventional” loan options that required a minimal down payment because of our good credit scores. At the time we thought we were given certain advantages because of our strong credit scores. However, after the collapse of the real estate bubble I learned that these offers were given to all sorts of people. Renowned writer Michael Lewis, in his book The Big Short: Inside the Doomsday Machine jests “In Bakersfield, California, a Mexican strawberry picker with an income of $14,000 and no English was lent every penny he needed to buy a house for $724,000.” This was a common theme with commercial mortgages as well. As borrowing standards began to fall, loan-to-value ratios increased significantly, with many lenders even offering loans for more than 100% of the collateral value.

So what happened? It turns out that lenders were instructed to make as many loans as possible so they could be securitized into a mortgage backed security. This is a common theme which we will explain shortly.

Variable interest rates, non-recourse loan clauses and foreclosures

Many borrowers were made to believe that they could afford mortgages by being offered two common superficial loan options. The first was very low “teaser” interest rates. The mortgage brokers would offer the borrower a “great rate” for the purpose of closing as soon as possible. Many of these borrowers did not look long term, when their interest rate would more than double, or thought at that point they would be earning more income and would not have a problem with the increased monthly payments. The second was offering borrowers 7 year balloon payment options, whereby borrowers did not have to pay back principal on the loan for 7 years. However, in most of these situations the loans had a non-recourse stipulation, where the borrower can be relieved of the mortgage financial liability by simply walking away from the house, which would lead to foreclosure. This was the perfect security blanket for these borrowers who were either “on the fence” or those that were ultimately tricked into thinking that they could actually afford to pay the loan they borrowed. This negatively affected the mortgage backed security, whose income stream is based on the interest payments of the loans, which would now cease to exist. Furthermore, you now have a lender take over this property that, if it can be sold at all, it would be sold for a fraction of the amount of the original loan, exacerbating the issue even more.

Misclassification of risk and ratings by the credit rating agencies

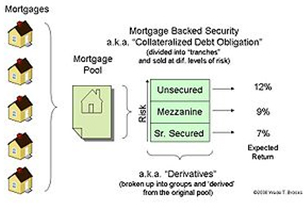

A mortgage backed security is a collection of mortgages which are securitized into a mortgage pool. This pool is split into tranches, which is based on risk. The first tranche is comprised of the highest rated loans (with the least amount of risk), so these investors get their money back first. The lower the tranche, the lower the ratings (and higher the risk), and therefore, these investors get paid last. However, because these investors are taking on more risk they receive a higher rate of interest than the investors in the higher tranches (see Figure 1 below).

Figure 1

Based on this description, the pillars with which the mortgage backed security stand come from the ratings of the actual mortgages and the formation of the tranches. When these ratings are incorrect, it creates an imbalance in the whole security. This, as well as the factors discussed above, led up to the crash of the mortgage backed security market.

Crash of the mortgage backed security market

As the old adage goes “hindsight is always 20-20.” After the mortgage backed security market came crashing down, many government officials, famous economists, financial analysts, and authors wrote about the crystal clear market indicators that existed preceding the crash, the same indicators that were ignored. Henry Paulson, the former U.S. Secretary of the Treasury states in his memoir On the Brink, “I misread the cause, and the scale, of the coming disaster. Notably absent from my presentation [to the President of the United States] was any mention of problems in housing or mortgages.”

The foreclosures were the beginning of the snowball effect. Once borrowers began defaulting on their loans, the lenders were stuck with properties at severely distressed values and their cash flow models came to a crashing halt. On top of this, failure of the credit agencies to properly rate the loans allowed the securitization process to occur without the correct information. Meaning, a loan with an AAA rating was just as likely to default as a loan with B rating.

We all know the rest of the story. The big Wall Street firms had billions of dollars worth of mortgage backed securities (and similar type assets) on their balance sheets. Once they were deemed worthless by Wall Street these giants began to fall. The irony is had someone at that point said that mortgage backed securities will make a rebound only a few short years later, they would have been considered crazy.

Mortgage backed securities 2.0

Back in 2009 there was virtually no issuance of mortgage backed securities. However, in 2010 approximately $17 billion were issued and, in 2011, an astounding $43 billion were issued. What has ultimately changed? Some believe that market professionals are acting as if they learned their lesson, while most believe the market has experienced this overall increase due to the evolution of various regulatory requirements, most notably the Dodd–Frank Wall Street Reform and Consumer Protection Act (the “Act”) and the Securities and Exchange Commission (the “SEC”) Rule 17g-7. The scope of this article will look at mortgage backed securities 2.0 through the three factors identified above.

Stronger borrowing standards

The Act, which President Obama signed into law on July 21, 2011, has made underwriting regulatory standards more robust since the 2008 crash. Our strawberry picker would no longer be able to receive the same loan he obtained prior to 2008. Borrowers are now required to submit credit history, realistic income expectations, employment status, current liability obligations, etc. Furthermore, to ensure underwriters are doing their job properly, the Act requires the underwriters to retain 5% of the credit risk for an asset backed security, with some exceptions. The ultimate goal of this section of the Act is requiring underwriters to think twice about taking unnecessary risks. What better way to do so than to keep these parties “on the hook” for their required percentage of the asset?

Delinquencies- will it get worse before it gets better?

According to a report released by Trepp, a leading provider of commercial mortgage backed securities information, analytics and technology, the delinquency rate among commercial mortgage backed securities jumped significantly by 31 basis points in March 2012 to 9.68%. This increase was the second largest monthly increase since July 2011. This rate is up from six months ago and one year ago when the rate was 9.56% and 9.42%, respectively. Serious delinquencies saw an increase over the month of March, rising 16 basis points to 9.10%. As with the overall commercial mortgage backed securities delinquency rate, the serious delinquency rate is higher than it was six months ago – 8.95% – and one year ago – 8.89%. Trepp “view[s] this as the first of a six to twelve month stretch where the rate could increase by 75 basis points in aggregate, as loans originated in 2007 begin reaching their balloon dates.”

This is consistent with a chart (Figure 2) published by Fitch Ratings, a well known company that offers risk services to investors and market participants, which depicts default rates for specific vintages and property types. Fitch similarly notes that 2006-2008 vintages are only halfway through their loan cycle, so there is a real possibility for maturity defaults in these vintages.

Figure 2

| Cumulative Default Rates Through Third-Quarter 2011a | |||

| Vintage | Default (%) | Type | Default (%) |

| 1993 | 3.0 | Hotel | 22.7 |

| 1994 | 4.8 | Multifamily | 17.9 |

| 1995 | 10.5 | Office | 9.4 |

| 1996 | 11.2 | Other | 7.1 |

| 1997 | 12.1 | Retail | 10.7 |

| 1998 | 9.7 | Industrial | 10.4 |

| 1999 | 10.2 | Healthcare | 23.8 |

| 2000 | 14.4 | ||

| 2001 | 13.7 | Total | 12.5 |

| 2002 | 8.2 | ||

| 2003 | 5.6 | ||

| 2004 | 7.3 | ||

| 2005 | 10.8 | ||

| 2006 | 14.6 | ||

| 2007 | 18.3 | ||

| 2008 | 15.2 | ||

| 2009 | NAP | ||

| 2010 | 0.0 | ||

| 2011 | 0.0 | ||

| Total | 12.5 | ||

a Cumulative default rates on Fitch-Rated multi-borrower transactions by origination vintage through September 2011.

Risk and credit agencies

In 2006, Congress passed the Credit Rating Agency Reform Act. This law gave the SEC the right to determine which credit rating agencies qualify as Nationally Recognized Statistical Rating Organizations (“NRSRO”) as well as the power to regulate their internal processes regarding record-keeping and how they guard against conflicts of interest. However, the law specifically prohibited the SEC from regulating an NRSRO’s rating methodologies. While these laws were pretty thorough on paper, they unfortunately were not being followed, causing Congress to use the Act (Dodd Frank) to bolster the SEC’s enforcement with respect to credit agencies. The Act adopted a number of new rules relating to reporting and disclosure requirements for credit agencies, such as annual reporting requirements on internal controls, application and disclosure of credit rating methodologies, other disclosures relating to performance statistics and third party due diligence, consistent application of rating symbols and definitions, specific and additional disclosure for ratings related to asset-backed security products, etc.

In addition to the Act, various credit agencies are doing more on their end to determine appropriate risk. Prior to 2008, agencies regularly utilized speculative cash flow projections as a main indicator in determining risk, such as vacant space becoming leased-up and below market rents increasing to market. When these projections did not come to fruition, they had adverse effects on the loan pools. Fast-forward to 2012, speculative cash flow projections are not being used in newly issued commercial mortgage backed securities. Rather, agencies look for more factual data, such as focusing on long term rental contracts to gauge potential income and using 12-month expense amounts and increasing them by a percentage to account for inflation (Fitch uses a 3% inflation increase). By sticking to more substantiated data, the ratings will be more accurate, which will ultimately translate to a more realistic rating and valuation of a mortgage backed security.

Conclusion

In August 2011 the first public commercial mortgage backed securities deal was issued by Deutsche Bank and UBS (70% public bonds and 30% private 144A bonds). The important aspect of this deal is that Deutsche Bank and UBS were willing to offer public bonds, since they carry a much higher liability for them as the issuers (and therefore less risk to the investors), due to the fact that information must be uniformly disclosed to all investors simultaneously and any public information provided that turns out wrong or misleading can be held against them as the issuer. This is good news for the mortgage backed security as public deals will attract a wider investor base since the investment is more transparent and carries less risk. This first issuance opened the floodgates and now public offerings have become more commonplace.

It is said that real estate operates on a ten-year cycle with seven years of memories. In order for the mortgage backed security to successfully evolve, it is crucial to not only stick to the rules created by Congress that address the aforementioned borrowing standards, loan structure and risk classification, but to continue to go above and beyond those rules. And not for seven years – but for the full ten.