Laundering Money in More Ways Than One

It seems every few months we read about a financial institution involved in a money laundering scandal. The bank typically agrees to pay a fine, promises to behave, hires consultants to monitor and report to the regulators, and the scandal is generally forgotten.

You may ask what do the consultants do and what do they monitor? This article will discuss the development of two recent scandals that made noteworthy headlines, the redflags to be watchful for and, the safeguards deployed to understand, monitor and control the risks.

The most recent example is of Danske Bank, founded in 1871 in Copenhagen, Denmark. Apparently, the Estonian branch of Danske was involved between 2007 and 2015 in the flow of $230 billion of illicit money from Russia across Europe and the rest of the world. The bank is saying it still doesn’t know whose billions moved through its remote branch over nearly a decade. The CEO has resigned, the stock has lost more than half of its value and the reputation of more than a hundred years left in tatters because of allegedly willful neglect.

We have seen similar cases where BNP Paribas was fined by the U.S. regulators to the tune of $9B. Among others charged and fined were HSBC, ING, and almost all the large U.S.-based banks. This rise in scandals has its roots in the globalization of finance, and most importantly a push in the political environment to make the banks more responsible for policing the criminal and terror-related money flows. The World Bank and the International Monetary Fund estimate that global fraud and money laundering constitutes about 3-5% of the world’s gross domestic product, or between $2.2 and $3.6 trillion a year.

Before 9/11, laws and regulations inherently focused on the drug trade and the illegal profits seeping back into the economy. The focus shifted after 9/11 to include to include terrorism financing, which was also traced to money laundering.

WHAT IS MONEY LAUNDERING?

Money laundering is essentially the processing of assets generated from a criminal activity to obscure the link between the funds and their illegal origins. Anti-money laundering (AML) refers to the controls that require a financial institution to deter, prevent, detect and report money laundering activities. The methods by which money may be laundered are varied and can range in sophistication. AML controls that have been implemented by statute include requirements that financial institutions file or report suspicious activity (i.e., Suspicious Activity Reports [SAR] and or Currency Transaction Reports [CTRs]) to report certain activities. FinCEN (the Financial Crimes Enforcement Network of the U.S. Treasury) also encourages voluntary filing related to any potential money laundering or terrorist activity.

Any organization that receives or disburses funds, whether by cash, checks, wires or other types of bank transfers, is susceptible to elements of fraud, corruption and money laundering. The source could be both internal and external, both domestic and international, and the regulatory impact could be both from receiving or disbursing funds. If the funds received have origins in a tainted source, it will have a reputational impact that will affect the financial institution and its stakeholders.

Some of the types of methods used to “launder” funds include:

If funds are disbursed to a known criminal enterprise, not only may it adversely impact the financial institution, but it may also subject the principals to criminal charges. Banks charged with crimes may be subjected to both civil and criminal penalties.

WATCH OUT FOR THESE RED FLAGS

Some red flags that may indicate a potential problem related to fraud, corruption or money laundering and result in a reputational risk, as well as expose a financial institution to civil and criminal charges, have origins in these types of transactions:

- Commissions and/or fees greater than the industry norm, especially outside of the U.S.

- Unnecessary or unusual middlemen.

- ”Special” invoices, or invoices with no discernible service being provided.

- Contributions received from or given to individuals or organizations with suspect background or credentials.

- Excessive travel and entertainment expenses.

- Unusual donations and/or expenses, especially related to sources outside of the U.S.

- Fee payments or monies transmitted and subsequent request of refunds for the same.

- Excessive wires and/or money transactions with countries identified for heightened risk for bribery, such as Russia, China, Brazil, Mexico, and India.

- Lack of review of any transactions from embargoed entities, countries or jurisdictions.

- Willful blindness, which generally results in a potential liability.

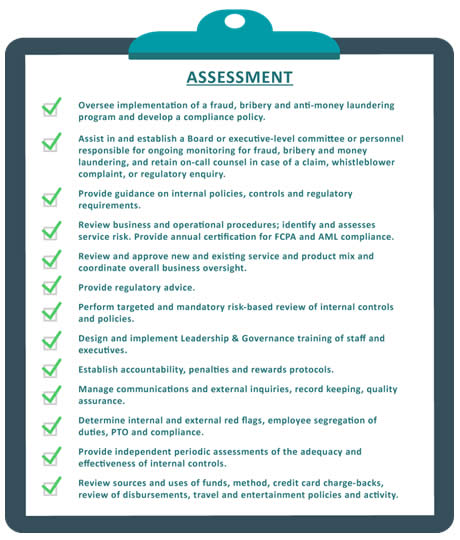

Marcum LLP has established a robust program to assist financial institutions in meeting their respective AML responsibilities. This program includes conducting risk assessments of financial institutions to create, implement and monitor a plan of internal controls and compliance to deter, monitor and detect fraud and money laundering. The actual assessment/plan is tailored to the financial institution’s size, number of employees, types of activity, funding sources, disbursements, and vulnerability to fraud and money laundering. An assessment could include the following elements for review, discussion and organizational impact: