How Often Should You Have Your Business Valued?

By Thomas Insalaco, CFA, CVA, Manager, Advisory Services

During the life of a business, several events will make a business valuation necessary, such as settling a dispute between shareholders or paying an owner’s estate taxes. But there are many benefits to regularly measuring the value of a business including:

- Knowing if you are getting an acceptable return on what is likely one of your largest assets.

- Gaining a better understanding of the key drivers and risks that impact your business’s value.

- Reducing the risk of litigation between shareholders as all shareholders will have a better understanding of the business’s value.

- Being better prepared to negotiate in the event of an unexpected offer.

So, how often should you have a business valuation performed? There is no right answer, but several factors should be considered. Figure 1 outlines key factors, which are discussed further below.

Figure 1. Factors to Consider in Determining Frequency of Valuations

| Factor | If Your Company | Then You Should Have Valuations Performed |

|---|---|---|

| Concentration Risks | Has more concentration risks | More often |

| Industry Volatility | Operates in a more volatile industry | More often |

| Multiple Owners/Buy-Sell | Has more than 1 owner | Annually and used for buy-sell pricing |

| Time Until Exit | Has a shorter timeline until next owner | More often |

| Cash Flow | Has more cash flow | More often |

Concentration Risks

The smaller the company, the more likely there will be significant swings in value resulting from:

- Concentration of business from a small number of suppliers or customers;

- Focus on a specific geographical area;

- Limited product offerings; or

- Leadership centered in a few key people.

Consider the following small publicly traded company with a market capitalization of about $50 million as of late February 2018, whose main service offering is designing and manufacturing shock absorbers. This company relies on a handful of customers for about half of its revenues, with the top five customers accounting for 49% in 2017. Revenue and margins have been volatile due to the reliance on a small group of customers as shown in Figure 2.

Figure 2. Historical Financial Information

| Year Ending May 31: | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|

| Revenue (in millions) | $29.007 | $24.730 | $20.001 | $30.589 | $35.680 | $25.537 | $24.364 |

| Gross Margin | 30.6% | 35.4% | 27.3% | 28.6% | 34.9% | 31.3% | 24.3% |

| Net Income Margin | 7.6% | 10.3% | 5.7% | 7.1% | 11.8% | 9.1% | 1.8% |

As can be seen in Figure 3, the company’s stock price has been volatile due to the swings in annual revenue from over-reliance on a handful of customers.

Figure 3. Stock Chart

Now consider the annual valuation based pricing line in figure 3. This line shows what pricing might look like if the company was not publicly traded and value was instead measured through annual valuations. Relying on the annual valuation is deceiving because the company’s value appears much more stable than it actually is. The difference between the actual stock price and the hypothetical price based on an annual valuation was as much as 42% over the five year period, and the differential exceeded 10% on 851 of the 1,259 trading days over the five-year period.

More concentration risks can make a company’s value more volatile, and more frequent valuations may capture those changes.

Industry Volatility

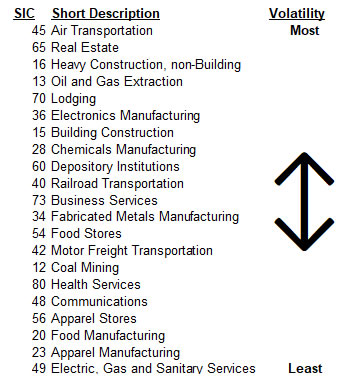

A company operating in a stable industry such as consumer staples or utilities is less likely to have large swings in value due to industry trends. Companies operating in industries with more volatility such as construction or travel are more likely to see large swings in value from industry trends and should have valuations performed more frequently relative to companies in stable industries.

Industry stability for select industry SIC code groupings, as measured by industry stock betas from Duff & Phelps U.S. Industry Cost of Capital, is shown in Figure 4 below.

Figure 4. SIC Industry Volatility

Multiple Owners

If your company has multiple owners, then a well thought-out buy-sell agreement should be in place to help determine how transactions will be handled. Pricing in buy-sell agreements is often based on formulas, but the product of a formula may not reflect the current value of a business interest. Unfair pricing as a result of a formula or poorly written buy-sell agreement can lead to animosity between the selling party and the remaining shareholders and potentially lead to litigation.

Having a valuation performed at least annually and using the resulting value to set pricing in a buy-sell agreement can help to keep all of the owners on the same page in terms of expectations in the event that one of the owners needs to exit. This will help to reduce the likelihood of shareholder disputes and litigation.

Time Until Exit

Business valuations can be used to help understand what the key drivers and risks are for the business. This information can be used to help increase the company’s value as you move closer to selling the business. If you are a long way from exiting the business, an occasional checkup will suffice. If you are within five years from selling the business, then you will want to have more frequent checkups to make sure you are on track to increasing value and reducing risk to assure you get the best valuation when you do exit.

Cash Flow and Profitability

A final practical matter to consider – how often can you afford to have business valuations performed? If your company does not produce any cash flow for the owners, then there may be little business value and little need to have regular valuations performed. If the company is producing significant amounts of cash flow for the owners, you may want to measure value more frequently. The exception to that rule of thumb would be companies that hold real estate or other assets that do not generate cash flow but are subject to market swings in value, and companies that are early stage and have yet to turn cash flow positive. Early stage companies, in particular, can require frequent valuations for many purposes before cash flow is strong. A good way to think about the cost of valuation is similar to how you would pay a wealth advisor based on a percentage of assets under management. Set aside a percentage of your company’s value to be used for activities to manage the wealth tied up in the business, including valuations, legal reviews, updating buy-sell agreements, etc.

Summary

In summary, treating your business like the investment that it is and having regular valuations performed will help to (i) identify key value drivers and risks; (ii) enable you to use that information to make better operational decisions; (iii) support wealth planning, exit or succession planning and estate planning; and (iv) reduce the likelihood of litigation between shareholders if someone needs to exit, as everyone will be aware of the appropriate value of the business.

If you would like to discuss valuation needs for your business, please contact me or another member of the Marcum Advisory team.