D&O and E&O Insights for Hedge Fund Managers

By Claudia Ramone, CLCS, Vice President of Sales, Maloy Risk Services

2014 was one of the more stable years for Hedge Fund Management Liability, Directors and Officers & Professional Liability. Rates were relatively flat compared to 2013. Insurer capacity increased with several new market entrants generating additional competition and there weren’t any significant claims to push rates higher as seen in 2012 and 2013.

In 2015, we expect to see a similar trend: a rise in the number of investigations, which comes as a direct result of the increased number of hired SEC investigators, as well as, fewer large scale claims due to enhanced compliance by fund managers as a result of more due diligence from investors and the heightened awareness around regulation.

We recently issued a white paper that provides a comprehensive overview of industry and coverage trends, pricing, claims management and the insurance placement process. The paper also provides a detailed review of insuring agreements included in –base’ vs. –manuscript’ policy forms, cost allocation trends on the manager vs. fund and how the insurance limits, retentions and price per million differ across various fund strategies.

This article will cover selected highlights from the white paper and those interested in receiving a comprehensive copy can make a request to the email provided at the end of this discussion.

Policy Highlights

The Management Liability policy is made up of at least two, and as many as six different coverage parts. Directors and Officers and Professional Liability (Errors & Omissions) are the two coverage parts that will always be on a hedge fund management liability policy and will be the focus of this article.

Often Employment Practices Liability, Crime, Fiduciary Liability and Cyber Liability are added to the contract, though this is not something we recommend to our clients. These policies are available at a much lower cost per million and in the event of a claim, we wouldn’t want something like a harassment or wrongful termination claim eroding the limit intended to provide defense to the funds, manager and Directors & Officers for regulatory investigations or other E&O claims.

Why Buy Coverage and How Much Do We Need?

The most common question from a new buyer of Management Liability is: why do we need this coverage if the fund indemnifies us pursuant to the fund documents? The answer is twofold: first, the fund will not indemnify directors, officers or employees for willful misconduct or gross negligence allegations, but the insurance will provide defense costs until a final non-appealable adjudication; and second, the policy backs the indemnification of the fund if the claims are indemnifiable.

This protects the fund assets by replacing the fund’s indemnification obligations for defense costs and judgments. Since the policy protects fund assets, a majority of the cost of the Management Liability policy is treated as an expense to the fund. The common percentage allocation is 80% to the fund and 20% to the manager.

When determining what limit to actually purchase, the buying decision can be impacted by a number of things, most typically a mandate by a prospective investor or outside director to carry a specified limit of coverage. In the absence of such mandates, the selection of a limit is influenced by budgetary considerations and (operational) risk appetite. We provide our clients with detailed benchmarking for comparable managers so they can evaluate what their industry peers are buying and paying for coverage based on their size, strategy and AUM.

Cost

There are several factors that set the pricing of policies, but are not necessarily limited to the following:

|

|

The primary layer of coverage for most funds starts with a $5MM or $10MM limit from the first insurer. Additional layers of coverage will increase by $5MM or $10MM depending upon the starting point of the tower of coverage, but all terms and conditions within the program are based on the primary layer’s policy wording.

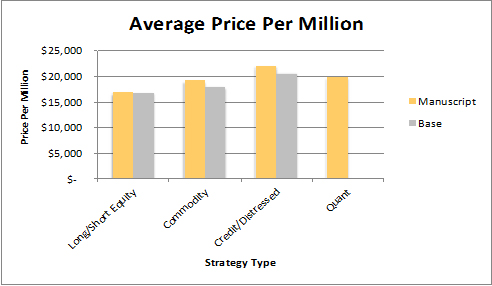

As illustrated below in the Price Per Million chart, the Long/Short strategy is typically the least expensive and the most desirable class of business for the underwriting community. The other three categories – Credit/Distressed Debt, Commodity and Quantitative strategies – are considered to be the most expensive. In general terms, pricing usually ranges from $15k – $25k per million of coverage.

Retention / Deductibles

The cost drivers that impact premium levels can also impact the retention or deductible amount. This would include the cost per claim that the manager or fund must pay out of pocket before the policy limit is applied. The $250,000 and $500,000 are fairly common deductible amounts. In some cases, a smaller manager with a relatively low risk Long/Short strategy with an AUM less than $200MM may see deductibles as low as $150,000 per claim, but it is increasingly rare to see it that low. In certain cases for the much larger funds, you may have the option to select a significantly higher deductible in order to lower the premium. The Cost of Corrections (aka –Trade Error’ coverage) typically has a higher deductible than that for other E&O claims.

Manuscript vs. Base Policy Forms

There has been an increasing trend in the purchase of manuscript policy forms. A Manuscript Form is a customizable policy that takes into account the specifics of your individual business and offers less exclusions providing a premium level of coverage to Insureds. One of the key differences between the forms is frequently how coverage is handled for regulatory inquiries and investigations. Buyers should be mindful of how coverage is triggered and which inquiry coverage, if any, is provided by their policy.

Base forms also do not have Cost of Corrections Coverage built into their policies. It must be added by endorsement and not all insurers in the space will offer this coverage. Many that do offer Cost of Corrections have limiting language and they place heavy restrictions on the definition of a Trade Error. In manuscript policies there are no such caveats; an error triggers coverage and the definitions of a Trade Error are much broader. (For a sample of the base versus manuscript form comparisons please request a full copy of the white paper).

Summary

The hedge fund management liability placement is highly specialized: from the specific insurers; to the specialty brokers; as well as the legal and financial considerations that go into the decision making process. Focus on contract terms, conditions, definitions, and exclusions that are customizable and be sure to include internal and external counsel to make the best decisions for both the fund and the management company.

The market is ever changing, so constant monitoring of the market, policy forms and litigation trends are essential to understand how much insurance to buy, which terms to negotiate and which insurers are providing the best protection and at what price. Work with specialized providers to make sure you are getting the best coverage for your fund and management company.

To request a full version of our white paper “Protecting Key Assets: A Guide to Hedge Fund Management Liability Insurance”, please email [email protected]

Ms. Ramone is Vice President of Sales and is responsible for new business production, risk management analysis and key client management for Maloy Risk Services with a focus on the firm’s Hedge Fund, Private Equity/Venture Capital and Technology practice areas. Maloy Risk Services is a fifth generation owned and operated boutique insurance brokerage founded in 1872. Since 1999, Maloy Risk Services’ Hedge Fund Practice has emerged as the leader in the industry by working with our clients, their outside counsel and the insurers to design customized solutions for Directors and Officers and Professional Liability coverage. As an industry-leading broker, the firm has created its own Manuscript Management Liability policy underwritten by Lloyd’s of London. The firm has offices located in Princeton, New York City, Winston Salem and Atlanta.