Collusive Fraud Schemes – When Employee Teamwork Hurts

By Nitasha Giardina, Manager, Advisory Services

Collusion is a secret cooperation for an illegal or dishonest purpose. 1 “When two or more individuals conspired to commit an occupational fraud, losses rose dramatically.” 2

Occupational fraud costs any organization dearly, especially if senior management perpetrates the fraud or if the fraud continues for several financial periods. “When employees collude in a fraud scheme, they can subvert the system of independent checks that might otherwise catch a fraudulent transaction, thus enabling them to steal larger amounts.” 3

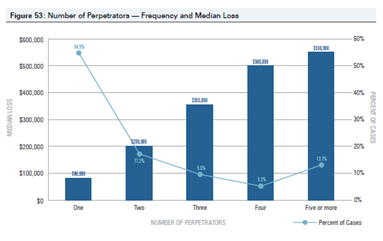

According to the 2014 ACFE Report to the Nations on Occupational Fraud and Abuse, even though more than half of frauds are committed by a single perpetrator, the amounts lost in collusive frauds are much higher. This is because the collusion aids perpetrators' circumvention of internal controls while also increasing the number of individuals expecting to profit from the scheme. The chart below compares the frequency and median loss of individual perpetrator and collusive fraud schemes.

While expanding the circle of people involved in the scheme can lead to larger losses, it can also lead to discovery.As Benjamin Franklin famously observed, “Three may keep a secret if two of them are dead.”

I first encountered a collusive fraud scheme while investigating a suspected fraud by an accounts payable clerk that ultimately cost his employer, a shoe manufacturer, $1.6 million over two years.This loss represented approximately 32 percent of the company's earnings during that period.

How did it happen?

As is so often the case, it began with inadequate segregation of duties.Here, the accounts payable clerk was responsible for almost all of the accounts payable functions. He prepared a list of vendor bills and company credit card accounts to be paid, drafted the checks for payment of these items, matched the supporting documentation for the item to be paid, mailed the checks and recorded the payment in the company's accounting system.

The accounts payable clerk took advantage of this lack of segregation of duties by printing checks to real vendors to pay for phony invoices. After the checks were signed, he would substitute his name, or the name of an entity he controlled, as the payee and cash the checks.

However, since the company did have some segregation of duties, the accounts payable clerk needed the help of another employee to avoid detection.The accounts payable clerk colluded with the mail room clerk to make sure that the accounts payable clerk received the bank statements before they reached the bank reconciliation clerk. He then removed the cancelled checks that had his or his entity's name on them and resealed the envelope. The mail room clerk then delivered the envelope to the bank reconciliation clerk, who was unaware of the tampering.

Other Deficiencies within the Company

In addition to the collusion between the accounts payable and mail room clerks, this fraud was able to continue for two years because of the company's inadequate bank reconciliation process. When the bank reconciliation clerk received the bank statement, he only compared the check numbers and amounts on the bank statement with the information in the check register. This information matched because the accounts payable clerk only changed the payee name on the check, not the check number or amount. Had the bank reconciliation clerk compared the physical cancelled checks to the check register he would have discovered that cancelled checks were missing.

The company's audit was also flawed. The auditors not only missed the lack of segregation of duties in the accounts payable department; they never did a walkthrough of the bank reconciliation process at the company.The auditors determined, incorrectly, that any risk of cash misappropriation by the accounts payable clerk was mitigated by a separate employee performing the bank reconciliation, the company's hands-on management environment, the dual signature requirement on checks, and review of all back-up invoices for its cash disbursements.

How was it caught?

In the third year of the fraud, the company performed an analysis of its expenses because its net profit margins were declining despite a noteworthy increase in sales. The analysis revealed to the controller a significant increase in certain expenses that were unrelated to the increase in sales.This led him to perform a review of each item recorded in those expense categories, which revealed the checks written to the vendors for phony invoices and the checks written to the accounts payable clerk and entities he controlled.

How to Prevent or Minimize Fraud

This fraud was a combination of collusive fraud and a fraudulent disbursement scheme. It thrived because of weak internal controls and audit inefficiencies. To avoid becoming the victim of collusive fraud, an organization needs to reevaluate its control environment and engage fraud professionals to assess the risk of fraud within their organization. Such assessments would reduce the opportunity to carry out fraud within the organization.

The areas most vulnerable to fraud include:

- Accounts receivable, cash receipts

- Accounts payable, cash disbursements

- Fixed assets

- Payroll and expense reimbursement

- Inventory

Companies should also consider the following red flags of fraudulent disbursements:

- Invoices for unspecified consulting or other ill-defined services

- Vendors with no physical address

- Vendors with company names consisting only of initials

- Large billings broken into multiple smaller payments

- Payments outside the accounting system, such as manual checks and petty cash

- Payment requests lacking supporting documentation

- Altered documents, e.g., backdating or changed names or addresses

Behavioral Changes

Since collusive fraud is more difficult to identify and catch through typical controls, it is important that a company be on the lookout for behavioral changes in its employees. Specifically, employers should look for the following personal issues or financial pressures that can sometimes lead an employee to commit fraud:

Personal Changes:

- Absenteeism

- Regular ill health or “shaky” appearance

- Series of “creative explanations”

- High level of self-absorption

- Inconsistent or illogical behavior

- Forgetfulness or memory loss

Financial Pressures

- Divorce

- Medical bills

- Spousal job loss

- Lifestyle maintenance

- Debt

- New or increased family/parental responsibilities

Conclusion

While collusive frauds are not as common as frauds perpetrated by individuals, they are more dangerous because they are more difficult to detect and usually result in larger losses.For these reasons, companies need to continually evaluate their internal controls to limit the opportunities for their employees to collude with one another.

2. http://www.acfe.com/rttn/docs/2014-report-to-nations.pdf, at p. 46<

3. Id.