2017 Cost of Living and Inflation Adjustments

Thanks to Michael Schonig, Tax & Business Services Supervisor, for his contributions.

The Internal Revenue Service has announced new additions to the cost of living and inflation rate increases for several tax-related attributes for the 2017 year. The following summarizes adjustments announced to date.

- The maximum amount of earnings subject to the Social Security tax will increase to $127,200.

- The earnings limit for workers who are younger than full retirement age (age 66 for people born in 1943 through 1954) will increase to $16,920.

- The earnings limit for people turning 66 in 2017 will increase to $44,880.

- The amounts that can be deducted by businesses under Section 179 will increase from $500,000 to $510,000. The limitation on Section 179 eligible property placed in service during the tax year will increase from $2,010,000 to $2,030,000.

- The generation-skipping tax exception and lifetime estate and gift tax exclusion have increased from $5,450,000 to $5,490,000 for the estates of decedents who die during 2017.

- The amount of unearned net income that a child can earn without paying any federal income tax is $1,050. All unearned income in excess of $2,100 is taxed at the parent’s tax rate.

- A number of tax items are unchanged in 2017, since the threshold only changes if the inflation adjustment increase is greater than $1,000. As a result, the personal exemption stays at $4,050; the ceiling on 401(k) retirement account contributions remain at $18,000; and annual gift tax exclusions are $14,000. Employer-provided fringe benefits for parking and transit remain at the 2016 amount of $255.

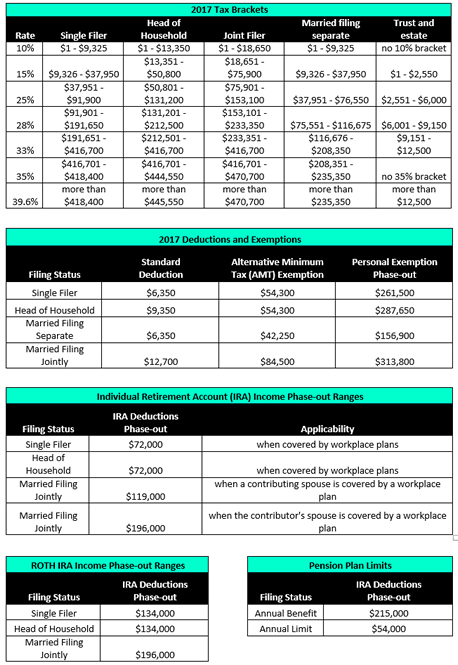

The following are additional items that have been adjusted for 2017:

The IRS has released a list of inflation adjustments within Rev. Proc. 2016-55, which can be found at https://www.irs.gov/pub/irs-drop/rp-16-55.pdf.

Further, Marcum has included many of these adjustments within our 2016 Year-End Tax Guide.

Should you have any questions about how the cost of living adjustments might affect your planning or questions regarding new rates or thresholds, contact your Marcum tax advisor.