AMT EXEMPTION

| AMT EXEMPTION |

2017 |

| Foreign Source Taxable Income |

$1,000,000 |

| Foreign Income Taxes (34%) |

$340,000 |

| U.S. Individual Federal Income Taxes (39.6%) |

$396,000 |

| Less Direct Foreign Tax Credit |

($340,000) |

| Total U.S. and Foreign Taxes |

$396,000 |

| |

|

| U.S. Effective Tax Rate |

39.60% |

Note: As AGI increases over a certain thresh- old, the AMT exemption is phased out.

2017 CORPORATE TAX RATES

| OVER |

BUT NOT OVER |

THE TAX IS |

OF THE AMOUNT OVER |

| $– |

$50,000 |

15% |

$– |

| $50,000 |

$75,000 |

$7,500 + 25% |

$50,000 |

| $75,000 |

$100,000 |

$13,750 + 34% |

$75,000 |

| $100,000 |

$335,000 |

$22,250 + 39% |

$100,000 |

| $335,000 |

$10,000,000 |

$113,900 + 34% |

$335,000 |

| $10,000,000 |

$15,000,000 |

$3,400,000 + 35% |

$10,000,000 |

| $15,000,000 |

$18,333,333 |

$5,150,000 + 38% |

$15,000,000 |

| $18,333,333 |

— |

35% |

— |

INFLATION/COST OF LIVING TAX UPDATES

| TAX BENEFIT |

2017 |

| Personal/Dependent Exemption |

$4,050 |

| STANDARD DEDUCTION |

| Married Filing Joint |

$12,700 |

| Single |

$6,350 |

| Married Filing Separately |

$6,350 |

| Head of Household |

$9,350 |

| Foreign Earned Income Exclusion |

$102,100 |

| Maximum Taxable Social Security Earnings Base |

$127,200 |

PHASE-OUT OF ITEMIZED DEDUCTIONS: THE “PEASE” LIMITATIONS

| FILING STATUS |

AGI THRESHOLD FOR PEASE LIMITATION 2017 |

| Married Filing Jointly |

$313,800 |

| Married Filing Separately |

$156,900 |

| Single |

$261,500 |

| Head Of Household |

$287,650 |

Subject to limitations, certain itemized deductions are phased out once Adjusted Gross Income (AGI) exceeds certain thresholds.

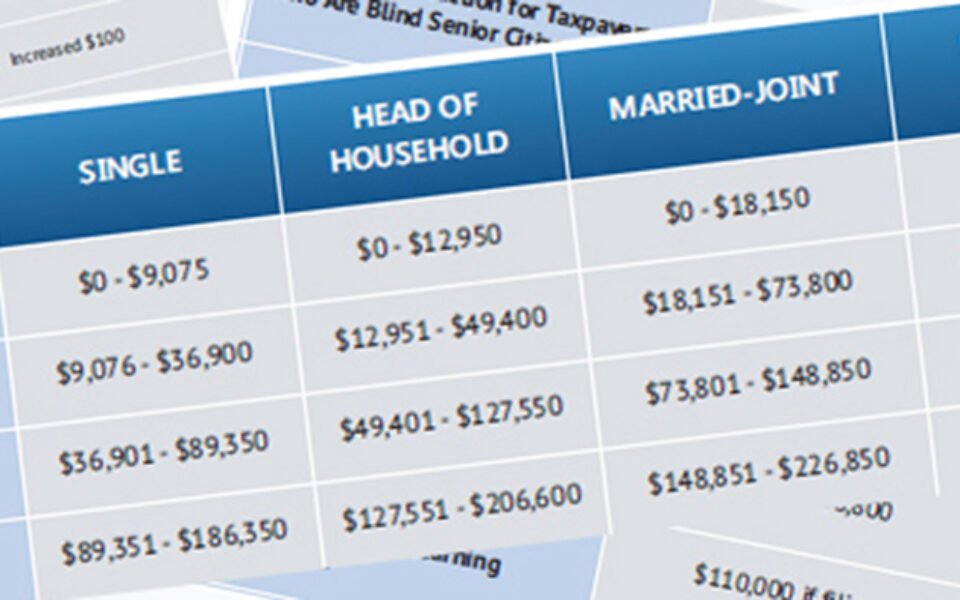

2017 INDIVIDUAL INCOME TAX RATES

| RATE |

SINGLE |

HEAD OF HOUSEHOLD |

MARRIED-JOINT |

MARRIED-SEPARATE |

| 10% |

$0 – $9,325 |

$0 – $13,350 |

$0 – $18,650 |

$0 – $9,325 |

| 15% |

$9,326 – $37,950 |

$13,351 – $50,800 |

$18,651 – $75,900 |

$9,326 – $37,950 |

| 25% |

$37,951 – $91,900 |

$50,801 – $131,200 |

$75,901 – $153,100 |

$37,951 – $76,550 |

| 28% |

$91,901 – $191,650 |

$131,201 – $212-500 |

$153,101 – $233,350 |

$76,551 – $116,675 |

| 33% |

$191,651 – $416,700 |

$212,501 – $416,700 |

$233,351 – $416,700 |

$116,676 – $208,350 |

| 35% |

$416,701 – $470,700 |

$416,701 – $444,550 |

$416,701 – $470,700 |

$208,351 – $235,350 |

| 39.60% |

Over $470,701 |

Over $444,551 |

Over $470,701 |

Over $235,351 |

2017 TAXABLE INCOME THRESHOLD

| FILING STATUS |

2017 TAXABLE INCOME THRESHOLD FOR THE 20% RATE FOR LONG-TERM CAPITAL GAIN AND QUALIFIED DIVIDENDS |

| Married Filing Jointly |

$470,700 |

| Head of Household |

$444,550 |

| Single |

$418,400 |

| Married Filing Separately |

$235,350 |

| Trust & Estates |

$12,500 |

DOLLAR LIMITS FOR RETIREMENT PLANS

| PLAN TYPES |

2017 LIMITS |

| Defined contribution plans |

$54,000 |

| Defined benefit plans |

$270,000 |

| Defined contribution plans – 401(k), 403(b) and 457 plans: Under age 50 |

$18,000 |

| Age 50 and older |

$24,000 |

| SIMPLE plans: Under age 50 |

$12,500 |

| Age 50 and older |

$15,500 |

| IRA, traditional and Roth: Under age 50 |

$5,500 |

| Age 50 and older |

$6,500 |

| IRA AGI Phase-Out (married) |

$99,000 |

| IRA AGI Phase-Out (single/HOH) |

$62,000 |

| OTHER THRESHOLDS |

2017 LIMITS |

| SEP Annual compensation limit |

$270,000 |

| Key employee in a top-heavy plan |

$175,000 |

| Highly compensated employee |

$120,000 |

| Social Security Wage Base |

$127,200 |

2017 ESTATES AND TRUSTS TAX RATES

| OVER |

BUT NOT OVER |

THE TAX IS |

OF THE AMOUNT OVER |

| $– |

$2,550 |

15% |

$– |

| $2,551 |

$5,950 |

$382.50 + 25% |

$2,550 |

| $5,951 |

$9,050 |

$1,232.50 + 28% |

$5,950 |

| $9,051 |

$12,400 |

$2,100.50 + 33% |

$9,050 |

| $12,401 |

$– |

$3,206 + 39.6% |

$12,400 |

GIFT & ESTATE TAX EXEMPTION

| |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

| Gift Tax Exemption |

$5,120,000 |

$5,250,000 |

$5,340,000 |

$5,430,000 |

$5,450,000 |

5,490,000 |

| Estate Tax Exemption |

$5,120,000 |

$5,000,000 |

$5,340,000 |

$5,430,000 |

$5,450,000 |

5,490,000 |

| GST Tax Exemption |

$5,120,000 |

$5,250,000 |

$5,340,000 |

$5,430,000 |

$5,450,000 |

5,490,000 |

| Highest Estate & Gift Tax Rates |

35% |

40% |

40% |

40% |

40% |

40% |